So in past few months, a lot of people have had questions:

Why would you risk your full-time job for a part-time endeavor?

What makes you different than other investment advisors?

What do you get out of it?

Well, after some time, I put pen to paper (or keys to word document?) and wrote down my answers.

Armed with the usual snark that clients love and readers crave, let's dive into why I started EID Capital and discuss my competitive advantages.

Why Start EID Capital?

It all started with many sleepless nights three-ish or so years ago. Laying in bed, channelling my inner Peggy Lee, and asking myself questions like, “Is this all there is?” and “Was I really put on earth to make a wealthy family more money?”

All the while, I’d frequently receive investment questions from friends and family like, “What should I invest in?” with the occasional follow up comment “I wish you could just it for me!”

So with those in mind, starting EID Capital really seemed like a no brainer. Helping the people I care about AND avoiding an existential crisis? Check and check.

The firm formally launched in November 2021 as an extremely private, part-time endeavor. And as you know by now by reading this, I took EID Capital full-time and public in 2024.

What Motivates You?

Love and hate, both professionally and personally.

Professional

Professionally, I love figuring out the daily “puzzles” and "challenges" that come with helping clients reach their financial goals. It's incredibly meaningful and enjoyable work. I take the responsibility of changing people's lives through my recommendations and analysis extremely seriously.

On the other end of the coin, I hate “financial advisors” that see people not as individuals with worries and dreams but instead as lumps of money from which to collect fees. I also loathe the insurance salesman cosplaying an investment professional who misleads their clients just to sell them commission-ladened products they really don’t need.

Simply put, both these groups are willing to negatively impact their clients’ current financial picture (and thus future outcomes) to generate fatter paychecks. I consider those who betray their clients’ trust (many of whom are their personal friends and family) for more money a blight on society. I'm motivated to remedy this behavior by doing business the right way. Which is by running a firm that's 100% transparent and honest.

Personal

Discussing personal motivations, I believe,

when you get paid

to do what you love,

for the people you love,

which consequently leaves a positive impact on society,

you’re on your way to living a satisfying and meaningful life.

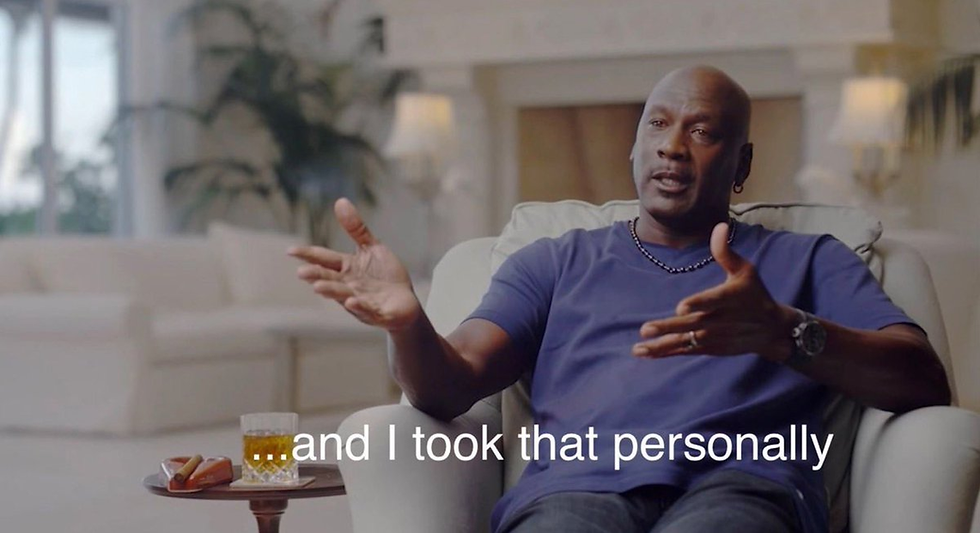

Hate-wise, fully admitting I’m not perfect and a little petty, I'd GREATLY enjoy having people who didn't believe in me eat crow. Yeah I know, I should let it go and at 34 you'd think I'd be a more evolved human being, but what can I say?

It's "petty psychic income" but income nonetheless.

What Are Your Competitive Advantages?

I CARE, A LOT (like A LOT, A LOT)

Starting off, I truly, truly, TRULY give a damn about my clients! Again, I know what you’re thinking, everyone says this. But, I think current clients will attest to this as I frequently go above and beyond to help them out! Taking meetings after normal work hours and weekends to accommodate their busy lives, extending meetings well past their designated length and occasionally well into the night, road tripping across the state to see them in person, and even trying to help one secure a new job are some such examples.

I treat all my clients like my family.

I'm much more motivated by the intrinsic benefits of helping people achieve their goals instead of the extrinsic benefits that come with it (i.e., notoriety, awards, etc.). Sure, if I receive the those things, cool, but receiving accolades is secondary to doing good work. There’s very few better feelings in life than having someone tell you that they’re lucky to have you!

Many other investment managers are more motivated by what industry peers think and how quickly they can grow assets under management. Me? Not so much. If my clients are happy, I’m happy. The extrinsic benefits will follow.

Institutional Investment Experience and Expertise

Alright, so the “skins on the wall” portion. Professionally, I have over eight years of professional investment experience working for an institutionally sized single-family office located in Dallas, Texas. Also, while working full-time, I started and brought EID Capital to break-even profitability while it was only a part-time endeavor. Finally, I have my Chartered Financial Analyst (CFA), Chartered Alternative Investment Analyst (CAIA), and Financial Risk Manager (FRM) designations and passed all of them on my first try 🤓.

That's what you can put on a resume but personally I've been researching, picking, and managing investments for far longer than eight years. True story, I remember telling my 6th grade counselor that I wanted to "do stocks" for a living.

So yeah, I've been passionate about this stuff for a loooooong time.

Superior Portfolio Management and Exclusive Investment Opportunities

So why is all of that valuable? Well, getting down to the nitty gritty of my investing competitive advantages.

I’m,

one, more qualified to implement more advanced portfolio management strategies for clients and

two, have a larger investment opportunity set than your run of the mill manager.

Integrating option strategies for risk management purposes and yield enhancement opportunities, having access to top-tier private market managers, and investing in non-recourse debt vehicles (i.e., leveraged ETFs) to generate larger than public market returns are some specifics.

Lacking the necessary experience and expertise, other investment managers risk severely damaging or even "blowing up" their clients' portfolios when attempting to employ identical strategies and invest in the same private assets.

Independent Thinking

In addition, I formulated my own investment and portfolio management philosophy developed through many years of research and testing and not by blindly following and echoing industry thought leaders of the past and present.

Some examples are that I don’t believe that portfolio optimization is particularly useful because correlations are rarely stable throughout market cycles, and factor investing doesn’t work in today’s more efficient market. If you’re buying a company because it’s cheap based on traditional valuation metrics, you’re more likely falling into a “value trap” where you’re overpaying for a crap company or you truly don’t understand why a company is “trading cheap”. However, other managers will persist with a strategy long after its useful life, leaving the clients to pay for their stubbornness and/or ignorance.

I'm My Own Boss (Autonomy and Authenticity)

EID Capital is 100% owned and operated by yours truly. I can do whatever I want. I'm not bound by outside ownership or management pressures who push arbitrary profitability goals or restrict me from doing right by the client.

My general business philosophy is start slow, then grow, with client satisfaction at the forefront. This is much more sustainable and increases the odds of business success versus a "growth at any cost" strategy. To state the obvious, many other wealth managers are restricted by the rules and goals put in place by their employer, which may not have the client's best interests in mind.

To add to that, since I'm my own boss I can say whatever I want. Don't believe me? Well, FUCK. How many investment professionals can write FUCK in a blog post and distribute it out to the public? Don't get me wrong, I don't cuss like a sailor, I'm just proving a point.

Jokes aside, the combination of not caring what people think with the freedom of expression allows me call out things that are wrong with the industry and question conventional wisdom. If you work for Fisher Investments you have to think one way and if you work at Dimensional Fund Advisors you have to think another way. A rigid firm ideology gets you in trouble in investing, as markets are constantly changing, evolving, and adapting to inefficiencies that may have existed in the past but are no longer relevant.

To finish, because I'm allowed to say whatever I want, I'm able to authentically express myself to the public instead of throwing up some professional fasade. Meaning, whenever you speak to me, you're truly speaking to ME, fucks and all, and not a company representative who may act one way when speaking with you but another way behind your back.

So there you have it!

Awkward dismount.

Comments